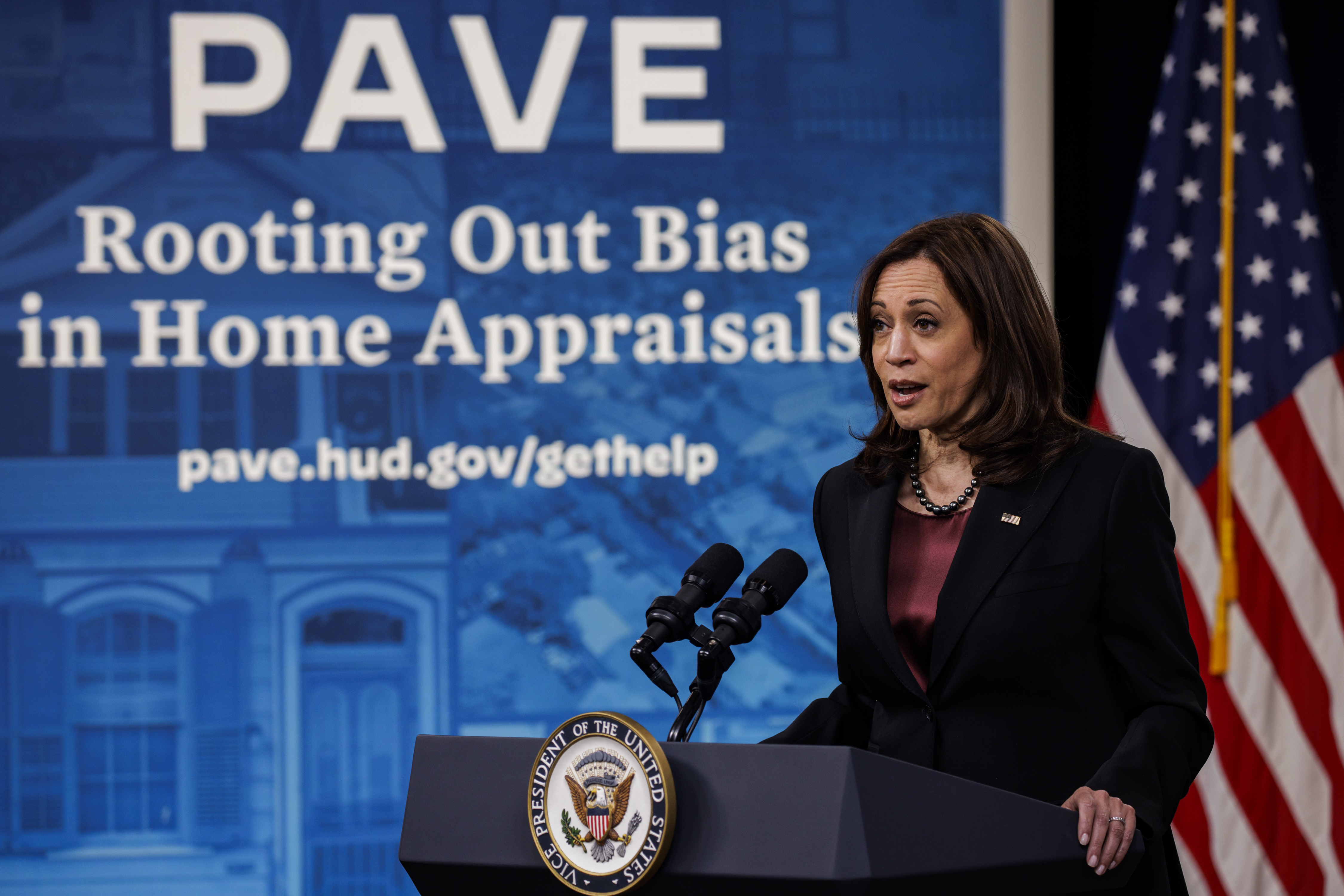

Vice President Kamala Harris speaks about the Property Appraisal and Valuation Equity, or PAVE, action plan upon its release in March 2022. Bloomberg News In 2021, the Biden administration convened a group of 13 federal agencies and tasked it with investigating racial bias in a key part of the mortgage lending process: property appraisal.More than three years later, Melody Taylor, the executive director of the Property Appraisal and Valuation Equity, or PAVE, task force, said the group has far exceeded the expectations assigned to it. “When the PAVE task force was introduced by President Biden, one of the things he asked us to do was to look at the causes and consequences of appraisal bias and discrimination, and I think we took it at least 100 feet further,” Taylor said. “We consulted with over 150 stakeholders and individuals to put forth an action plan consisting of 21 concrete actions.”But the task force’s efforts and output were not without controversy. Many in the appraisal profession felt the emphasis on personal bias — which they say has little effect on their valuation reports — was misguided, while the structural reforms within the industry were lackluster. Taylor, who also serves as regional director for the Mid-Atlantic Office of Fair Housing and Equal Opportunity for the Department of Housing and Urban Development, addressed these and other topics in an exclusive interview with American Banker. The following conversation has been condensed and edited for clarity.American Banker: When we look at the various actions from PAVE, which do you feel have already shown an impact and which ones do you see as more long-term investments in bettering this field?Melody Taylor: What comes to mind immediately is the aggregated data. Prior to PAVE there weren’t [many] opportunities for researchers, for the public at large and other industry members to access data to determine the trends in the industry. So our partnership with the Federal Housing Finance Agency in the aggregation of data has been substantial. It’s allowed researchers and communities to very easily pull out data and see trends or where there are appraisal gaps in value in particular communities. It’s triggered opportunities for cities. The city of Philadelphia has stood up a task force and they’re able to tease out this data and make recommendations on a local level. That, to me, was a substantial opportunity for us to make some changes within the industry. More recently, it’s been our enforcement work. In July, HUD entered into a historic conciliation agreement with Appraisal Foundation regarding its standards and qualifications for real estate appraisers to become an appraiser, to benefit from the industry. That agreement resolved a secretary-initiated complaint. The foundation was required to establish a $1.22 million scholarship fund that would essentially create scholarships for many who sought to become an appraiser so they can access the foundation’s Practical Applications of Real Estate Appraisal program, PAREA. We consider that a significant step forward in reducing those barriers to becoming an appraiser. Lastly, last year, we introduced reconsideration of value in two ways. The banking agencies introduced it so that depositories and nondepositories would have guidance around establishing reconsideration of value. And then internally to HUD, our fair housing administration office introduced reconsideration of value in its mortgagee letters. In both instances, government sponsored enterprises were instrumental in aligning those policies to create opportunities for borrowers to have a process for reconsideration of value. Melody Taylor, Executive Director of the Property Appraisal and Valuation Equity task force Ultimately, I believe that will reduce incidents of trying to figure out if it’s an inaccurate appraisal or if discrimination has occurred when an appraisal comes in that is lowballed. There have been lots of anecdotal accounts of lowballed appraisals and consumers not really knowing how or what to do. Empowering consumers to have a process for reconsideration of value serves many who touch the industry, right? The lender who owns the appraisal, the consumer who is impacted by the appraisal and the community at large, because we know that lowballed appraisals can have a compounding effect. So all those things added up, we believe strongly, have created a great opportunity for the industry as well as consumers. We take that as a big win. AB: The Appraisal Foundation has characterized the compilation agreement as, if not a clean bill of health, an acknowledgement that it is on the right track. It said it was going to create this scholarship fund no matter what and that it has the freedom to do so now that it does have the costs associated with the HUD probe. How do you square those differing views?Taylor: We’re an enforcement agency, and we sought to create a change in the industry and engaged in some substantial amount of research. When we reach an agreement there are two parties at the table with opposing positions. So from an enforcement perspective, we believed — based on the data — that there was [insufficient] access to the industry and the industry continued to represent that number that we’ve all heard: 97% white, male dominated. The industry did not represent the communities in which people live and serve. We didn’t get to $1.22 million without having an opposing position. We appreciate the Appraisal Foundation for coming to the resolution. We are very acutely aware that these funds are available and we will monitor and make sure that the implementation of these scholarships land in spaces and places that will seek to diversify the industry. But what I will say is it does not take away from the fact that the standards to access the industry remain the same. All other real estate industries do not require a college degree. The appraisal industry still requires that, that remains unchanged. And so, although this is a step in the right direction, getting us closer to building a diverse appraisal industry, there’s still more work to be done.AB: Consumer Financial Protection Bureau Director Rohit Chopra raised some issues with the foundation and its structure, calling it essentially a lawmaking body that is not held to the same standards as a government agency. Is there further work to be done on reforming the foundation? Taylor: When we talk about enhancing oversight and accountability in the appraisal industry, what you just described was one of the efforts, and to do so, it would take an act of Congress. It would take a legislative proposal to modernize the governance structure of the appraisal industry. We still believe strongly that that needs to happen, that transparency and public participation in establishing standards needs to happen. I will say, as a result of PAVE serving as a catalyzer in transforming the industry early on as it relates to [the Uniform Standards of Professional Appraisal Practice], TAF sought the assistance of one of the premier civil rights law firms to help them think through how appraisals show up in terms of interpreting the Fair Housing Act and its application. So, although the governance structure hasn’t changed, we believe that we’ve made some good strides in encouraging and pushing forward on some additional changes in the industry.AB: Some in the industry would like to see the Appraisal Subcommittee of the Federal Financial Institutions Examination Council take a more active role in monitoring how state and territorial licensing boards implement policies. It doesn’t seem like there was a lot of formal action on that front. Are there things that the subcommittee can and will be doing to get the states to follow more formalized processes or implement reforms where necessary?Taylor: The Appraisal Subcommittee has been challenged, quite frankly, from a human capital perspective. Resources have not allowed them to expand their team and their staff to do more significant work. However, they are embarking upon compliance reviews that would squarely put them in the space and place of states to look at how they’re implementing their programs and ensuring that they get to compliance. How that scales, obviously, is impacted by their human capital, but they have put forward a very significant plan to engage in more compliance reviews. Secondly, prior to PAVE, the Appraisal Subcommittee didn’t have a hotline that would appropriately refer complaints that came in. If something happens on a state level where there’s an inaccurate appraisal versus something that’s perceived to be discriminatory, who does it go to? I heard folks describe it as spaghetti against the wall. We believe now that they’re more fortified. This hotline will provide opportunities for referrals to HUD for investigation of complaints of discrimination, or to the CFPB. These things didn’t happen before. There’s a greater partnership with the Appraisal Subcommittee and Office of Fair Housing and our other enforcement agencies to provide training to state agencies. That has happened throughout, and we consider those early wins, but a consistent win because it takes it out of the hands of a larger entity to move this forward, and we’re really, truly on the ground, engaging with the state agencies to do this work.Lastly, the Office of Fair Housing, in conjunction with the department’s National Fair Housing Training academy, also has worked with state agencies to create a memorandum of understanding. For example, the state of Texas is working in tandem with the Texas Workforce Agency, so they have an agreement now that allows them a greater degree of communication. When a complaint comes through the doors of the state agency, there’s collaboration and discussion and there’s appropriate referral, so that investigations can happen within the purview of the Fair Housing Act. If it’s something that would require the Appraisal Subcommittee or others to take a look at as it relates to an accurate appraisal, then it’s more appropriately handled there.AB: Based on the data that’s been gathered, what more have you learned about the impact of personal bias on appraisals versus the legacy implications of things like redlining? There is frustration among many appraisers who say they are merely observing the market as it exists, not tilting it one way or another. Taylor: We recognized early on that data was necessary to remove it from the space of this being anecdotal, and really looking at where discrimination has happened, historically or not. We recognize that appraisals are a subset of the home buying process and that there are other players who have some responsibility in this — lenders being one of them. There are many facets and people who touch the home buying process. We believe all the historical accounts of discrimination, redlining and blockbusting all contribute to it and the appraisal valuation is a subset of that. Those are the truths and the truisms about it. Part two is that, from an enforcement perspective, in tandem with the TAF settlement, the Office of Fair Housing settled a case out of Denver and the facts in that case sit squarely on how the appraisal landed and how the lender responded to it. Those were not historic accounts. It was based on an appraisal management company that did not give a fair and equitable appraisal to an African American woman who had purchased a property that had been given an appraisal valuation of $800,000, went in for refinancing and got an appraisal that was almost $240,000 less, which prohibited her from moving forward on her loan. The property’s location sat at the cusp of a predominantly white community and an African American community, and the appraiser determined to go deeper into the African American community and looked at amenities that fell outside the scope of what we would traditionally see if you saw a home situated where this home was situated. I can’t say simply that the past is the driver of the market. Obviously, there are contributing factors, but there are decisions that are being made by individuals as well, around how and when appraisals happen and what valuation will be given. Thirdly, early on our partners at FHFA pulled data from 100,000 appraisal records and in those records were multiple accounts where you could see words and comments being made about the racial demographic of a neighborhood, the characteristic of the person or the neighborhood, which are all things that should not have a place in the valuation of a property and its structure. So, these are all contributing factors to why and how we see discrimination in the industry.AB: Another concern raised by appraisers is that there might be pressure on them to assign higher valuations than they might otherwise to avoid triggering a reconsideration of value or violating new standards that have been set out. What is your view on that? Are there sufficient controls to ensure that this doesn’t result in lenders overextending on mortgages? Taylor: This is the start of something we haven’t had before — guidance on reconsideration of values. This is first out the gate. The exercise of pulling in lenders and appraisers and advocacy groups and others to have this holistic discussion around policy should be a trend that continues. It will require banking agencies’ examination procedures and processes to play out over time, and for those groups to work in tandem with lenders and others to refine policies. I don’t think those can be isolated conversations. The guidance that’s been created provides opportunities for lenders to think through how to best implement these policies. FHFA and the GSEs are at the table and onboard with this, so being able to uniformly pull in the right people in the room to make sure that there are good policies being created and implemented is where we’ll get greater gains.AB: Is it fair to say the task force’s major actions have been taken and we’re now in a state of watching how they progress and, as you said, making adjustments? Or are there more significant initiatives ahead?Taylor: We have definitely made significant progress and critical progress over the course of time. There were 21 action items and these were not wage accounting, box checking things. These are meaningful actions. And we were purposed to do this work from an administrative perspective, so much of what has been accomplished can be embedded within each of the federal agencies. What you will see over time is that we will continue to do this work based on our existing portfolios. I hesitate to predict what will happen. It’s a political climate right now that may not be friendly to the work, but if we were closing the chapter on this book today, I would say to the chair and co-chair and to the federal partners, job well done.AB: What is the ultimate legacy of the task force and all that it has accomplished?Taylor: As the executive director, I have to raise up the data function. There are information sharing agreements that exist now and data sharing opportunities that didn’t happen before. The aggregated data, the commitment to potentially getting to a repository that could look like [the Home Mortgage Disclosure Act database], would be the most significant thing, if we could get there. But even in our current state, I think that the legacy of PAVE lives with the opportunity to use and leverage this data to create change. On a local level, it’s so user friendly, and it’s triggered discussions in places like Philadelphia, New Jersey and Maryland. It’s created opportunities for people to commit to change. Those are a compilation of significant things that are legacy situations for PAVE.

HUD official declares ‘job well done’ on appraisal bias task force

- Advertisement -