The Society of Motor Manufacturers and Traders (SMMT) recently released its August 2024 new car registration figures, revealing a slight 1.3% decline compared to the same month last year.

With 84,575 units registered, August’s figures reflect a traditionally quiet month for car sales, as buyers typically wait for September’s new number plates. However, the broader context surrounding these numbers points to significant challenges for the UK automotive sector, especially in light of the upcoming Autumn Budget on 30 October.

A review of industry comments following the release of the SMMT figures highlights several concerns about profitability, market growth, infrastructure gaps, and the need for stronger government leadership.

Fleet sales dominance and EV market growth

Fleet sales continued to dominate the market, accounting for 60% of all new car registrations in August, despite a slight decline. This dominance highlights ongoing structural challenges for manufacturers, as fleet sales are generally less profitable than private sales.

David Borland, EY UK & Ireland Automotive Leader, noted that the “less profitable fleet channel continues to dominate,” raising concerns about the broader impact on sustainable profitability for the industry. The heavy reliance on fleet sales underscores the difficulties manufacturers face in driving profitability while balancing regulatory and market pressures.

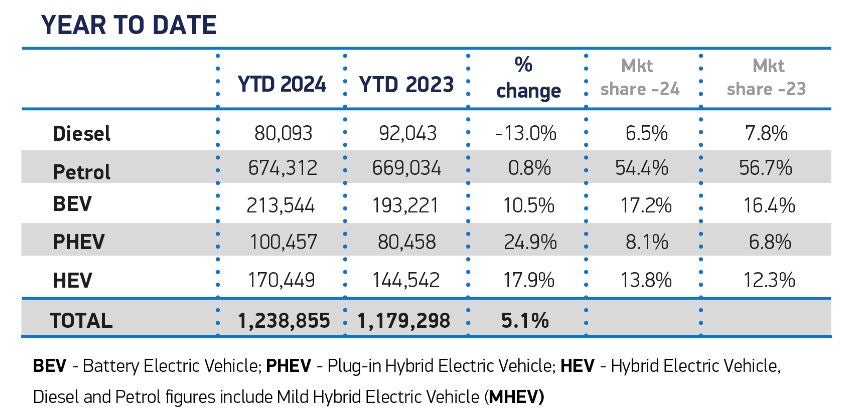

The positive news from the SMMT figures lies in the continued growth of battery electric vehicles (BEVs), which saw a 10.8% increase in registrations. This growth pushed BEVs to a 22.6% market share in August, the highest since December 2022. However, despite this progress, the sector remains under pressure to meet the Zero Emission Vehicle (ZEV) Mandate, which requires BEVs to reach a 22% market share for the year — a target that remains elusive, with year-to-date figures sitting at 17.2%.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

View profiles in store

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Country *

UK

USA

Afghanistan

Åland Islands

Albania

Algeria

American Samoa

Andorra

Angola

Anguilla

Antarctica

Antigua and Barbuda

Argentina

Armenia

Aruba

Australia

Austria

Azerbaijan

Bahamas

Bahrain

Bangladesh

Barbados

Belarus

Belgium

Belize

Benin

Bermuda

Bhutan

Bolivia

Bonaire, Sint

Eustatius

and

Saba

Bosnia and Herzegovina

Botswana

Bouvet Island

Brazil

British Indian Ocean

Territory

Brunei Darussalam

Bulgaria

Burkina Faso

Burundi

Cambodia

Cameroon

Canada

Cape Verde

Cayman Islands

Central African Republic

Chad

Chile

China

Christmas Island

Cocos Islands

Colombia

Comoros

Congo

Democratic Republic

of

the Congo

Cook Islands

Costa Rica

Côte d”Ivoire

Croatia

Cuba

Curaçao

Cyprus

Czech Republic

Denmark

Djibouti

Dominica

Dominican Republic

Ecuador

Egypt

El Salvador

Equatorial Guinea

Eritrea

Estonia

Ethiopia

Falkland Islands

Faroe Islands

Fiji

Finland

France

French Guiana

French Polynesia

French Southern

Territories

Gabon

Gambia

Georgia

Germany

Ghana

Gibraltar

Greece

Greenland

Grenada

Guadeloupe

Guam

Guatemala

Guernsey

Guinea

Guinea-Bissau

Guyana

Haiti

Heard Island and

McDonald

Islands

Holy See

Honduras

Hong Kong

Hungary

Iceland

India

Indonesia

Iran

Iraq

Ireland

Isle of Man

Israel

Italy

Jamaica

Japan

Jersey

Jordan

Kazakhstan

Kenya

Kiribati

North Korea

South Korea

Kuwait

Kyrgyzstan

Lao

Latvia

Lebanon

Lesotho

Liberia

Libyan Arab Jamahiriya

Liechtenstein

Lithuania

Luxembourg

Macao

Macedonia,

The

Former

Yugoslav Republic of

Madagascar

Malawi

Malaysia

Maldives

Mali

Malta

Marshall Islands

Martinique

Mauritania

Mauritius

Mayotte

Mexico

Micronesia

Moldova

Monaco

Mongolia

Montenegro

Montserrat

Morocco

Mozambique

Myanmar

Namibia

Nauru

Nepal

Netherlands

New Caledonia

New Zealand

Nicaragua

Niger

Nigeria

Niue

Norfolk Island

Northern Mariana Islands

Norway

Oman

Pakistan

Palau

Palestinian Territory

Panama

Papua New Guinea

Paraguay

Peru

Philippines

Pitcairn

Poland

Portugal

Puerto Rico

Qatar

Réunion

Romania

Russian Federation

Rwanda

Saint

Helena,

Ascension and Tristan da Cunha

Saint Kitts and Nevis

Saint Lucia

Saint Pierre and Miquelon

Saint Vincent and

The

Grenadines

Samoa

San Marino

Sao Tome and Principe

Saudi Arabia

Senegal

Serbia

Seychelles

Sierra Leone

Singapore

Slovakia

Slovenia

Solomon Islands

Somalia

South Africa

South

Georgia

and The South

Sandwich Islands

Spain

Sri Lanka

Sudan

Suriname

Svalbard and Jan Mayen

Swaziland

Sweden

Switzerland

Syrian Arab Republic

Taiwan

Tajikistan

Tanzania

Thailand

Timor-Leste

Togo

Tokelau

Tonga

Trinidad and Tobago

Tunisia

Turkey

Turkmenistan

Turks and Caicos Islands

Tuvalu

Uganda

Ukraine

United Arab Emirates

US Minor Outlying Islands

Uruguay

Uzbekistan

Vanuatu

Venezuela

Vietnam

British Virgin Islands

US Virgin Islands

Wallis and Futuna

Western Sahara

Yemen

Zambia

Zimbabwe

Kosovo

Industry *

Academia & Education

Aerospace, Defense &

Security

Agriculture

Asset Management

Automotive

Banking & Payments

Chemicals

Construction

Consumer

Foodservice

Government, trade bodies

and NGOs

Health & Fitness

Hospitals & Healthcare

HR, Staffing &

Recruitment

Insurance

Investment Banking

Legal Services

Management Consulting

Marketing & Advertising

Media & Publishing

Medical Devices

Mining

Oil & Gas

Packaging

Pharmaceuticals

Power & Utilities

Private Equity

Real Estate

Retail

Sport

Technology

Telecom

Transportation &

Logistics

Travel, Tourism &

Hospitality

Venture Capital

Tick here to opt out of curated industry news, reports, and event updates from Motor Finance Online.

Submit and

download

Visit our Privacy Policy for more information about our services, how we may use, process and share your personal data, including information of your rights in respect of your personal data and how you can unsubscribe from future marketing communications. Our services are intended for corporate subscribers and you warrant that the email address submitted is your corporate email address.

Philipp Sayler von Amende, Chief Commercial Officer at Carwow, pointed out that while the BEV market shows promise, “leads are taking longer to convert,” with consumers requiring more information and reassurance before committing to an electric vehicle. This slow conversion rate highlights the ongoing challenges in achieving mass adoption of EVs, a concern echoed across the industry.

Government policy and infrastructure gaps

The industry’s ability to meet ZEV targets is further complicated by gaps in infrastructure and consumer confidence.

Jamie Hamilton, Automotive Partner and Head of Electric Vehicles at Deloitte, emphasised that “concerns around charging” remain a significant barrier to EV adoption, particularly for consumers without access to off-street parking. The need for a more robust charging network is becoming increasingly urgent as EV sales rise, but the pace of infrastructure development has not kept up with demand.

Kim Royds, Director of Mobility at Centrica, added that addressing the inequality between home and public EV charging is critical. Without a concerted effort to expand and improve the public charging network, the shift to electric vehicles could stall, undermining the government’s ambitious targets for the sector.

Industry calls for government action

As the automotive industry grapples with these challenges, all eyes are on the government’s upcoming Budget.

Mike Hawes, SMMT Chief Executive, acknowledged the growth in EV sales but warned that “urgent action must be taken to help buyers overcome affordability issues and concerns about chargepoint provision.” This sentiment is widely shared across the industry, with calls for the government to reintroduce incentives for EV buyers, improve public charging infrastructure, and reconsider policies that could disincentivise EV adoption, such as the Vehicle Excise Duty (VED) supplement for expensive cars set to be introduced in 2025.

Ali Fitt, EY UK Automotive Tax Director, pointed out that while the market has shown resilience, the “longevity of such growth” remains in question. He stressed that manufacturers need to strike a balance between regulatory compliance, consumer appeal, and competitive pricing — a complex task that requires a supportive policy environment.

Nick Williams, Managing Director at Lex Autolease, urged the government to “support the transition” to EVs by providing a stable policy backdrop and further incentives to ease the transition for consumers and businesses alike. The industry is particularly keen to see measures that address consumer misperceptions about battery life and running costs, as well as initiatives to boost the affordability of new EV models.

Lisa Watson, Director of Sales at Close Brothers Motor Finance, echoed these concerns, highlighting that while demand for battery electric vehicles is strong, high upfront costs and infrastructure shortfalls continue to act as barriers for motorists. Her observation that fleet statistics “skew the data” also points to the complexity of interpreting market trends, as fleet purchases often mask the challenges faced by individual buyers. Watson’s comments underline the need for targeted government interventions to support private buyers and ensure that EV uptake is not driven solely by fleet sales.

2030 deadline

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), observed that, as the year progresses, the ZEV mandate will come under greater scrutiny, particularly with the government’s reaffirmation of the 2030 phase-out date for new internal combustion engine cars.

Ben Nelmes, CEO of New AutoMotive, shared a more optimistic view, noting the “continued growth in the number of people opting for an electric car” and highlighting the declining sales of petrol and diesel vehicles as a sign that consumers are increasingly “shunning older, polluting technologies.” Nelmes also suggested that the government can confidently reintroduce the 2030 ban on petrol and diesel sales, given the strong market performance of electric vehicles.

The road ahead

As the automotive sector awaits the Autumn Budget, the stakes could not be higher. The government’s response will be critical in determining whether the UK can meet its ambitious EV targets and maintain the growth momentum seen in recent months. With the ZEV mandate looming and infrastructure gaps still prevalent, the industry is looking for clear signals that the government is committed to supporting the transition to electric vehicles.

In the short term, September’s registration figures — buoyed by the introduction of the new 74 plate — will provide a clearer indication of market demand. However, the longer-term outlook will depend on the policy decisions made in the coming weeks. The industry’s resilience has been tested, but as the UK continues its journey towards a zero-emission future, it is clear that government support will be crucial in navigating the challenges ahead.

Industry demands clear EV incentives following Labour’s legislative omission

Labour’s King’s Speech leaves EV sector uncertain