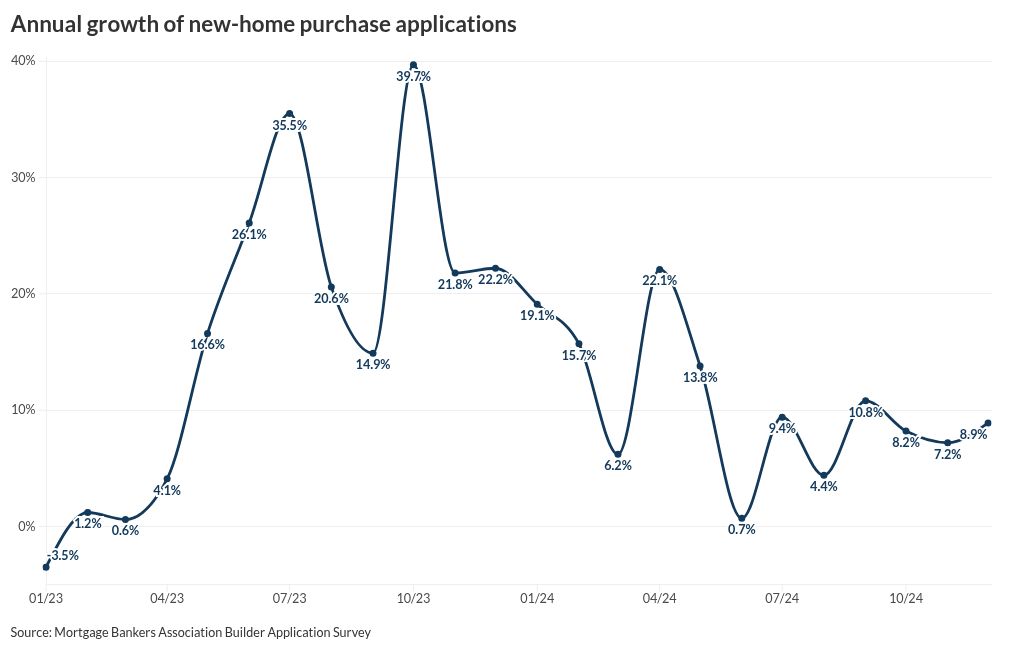

Newly constructed home purchases continue to benefit from the lack of existing inventory for sale, with the Mortgage Bankers Association’s Builder Application Survey again rising on an annual basis.

On an unadjusted basis, applications to buy a brand new home rose 8.9% year-over-year in December, continuing a streak that started in February 2023. Volume compared to November was down by 3%, which MBA deputy chief economist Joel Kan attributed to normal seasonal factors.

In November,

Applications to use the Federal Housing Administration program for a new-home purchase reached the second highest level in the BAS history at 29%, Kan continued.

“First-time home buyers remained active

The trade group estimates that new single-family home sales were running at a seasonally adjusted annual rate of 601,000 units for December.

This is a drop-off of 15.7% from November’s pace of 713,000 units.

On an unadjusted basis, 46,000 new home sales took place in December, a decrease of 6.1% from 49,000 units in November.

While FHA loans made up 29.4% of the application volume, 60% were for conventional mortgages, Veterans Affairs had a 9.9% share, while the remaining 0.5% were from the U.S. Department of Agriculture Rural Housing Service Program.

In good news when it comes to affordability, the average loan size for these properties decreased to $400,930 in December from $402,873 in November.

A separate report from Redfin found pending home sales fell 4.5% in December versus November. More alarming was the rate of pending home sales that fell through, a mark that reached a record high in December.

Nearly 40,000 home-purchase agreements were canceled in December, or 16.2% of transactions which went under contract. That’s the highest December percentage in records dating back to 2017 and is up from 15.1% a year earlier.

Year-over-year, pending sales fell by 2.3%.

“Home buying activity will likely slow further in January due to